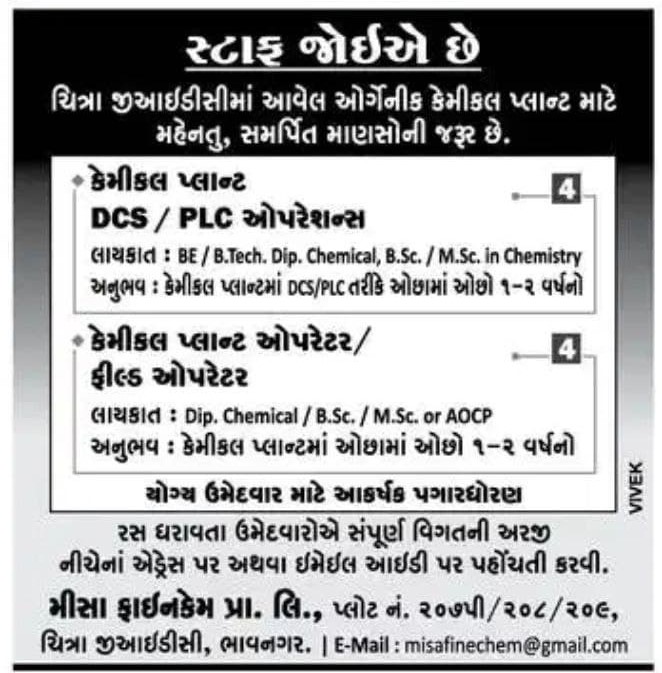

For Misa Finechem Pvt. Ltd.

- DC Operate DCS / PLC for chemical plant

- Chemical plant operator

For Mr. Khodal Tractor

- Sales Man – 5

- Office Boy – 1

- Mechanic – 1

- Helper – 1

Medinex Required

- Assistant QC Chemist

- Assistant QA officer

- microbiologist

108 walk-in-interview

- Vadodara, Panchmahal, Rajkot, Junagadh, Surat, Valsad, Bhavnagar, Narmada

- Contact 079 22814896/7227913108 for more details

Bansi City Bus Office Gangajalia Lake Bhavnagar

- Security guard wanted

- Mail / age 30 to 40 years

Sister needed for office work

- Contact 96 62 96 99 99

articles on newspapers, et cetera, you would understand this concept really well. So please explain it for the benefit of others. Or so it’s a great store of value. No one is coming close to Bitcoin in terms of store of value, and therefore all these three investment thesis is something that I believe in. I can be wrong. I’m not saying that I’ll 100% be right, but this is the thoughtful narrative in which I believe. I do not believe in the argument that governments will put blanket bans forever. That is impossible to do.

They might ban temporarily, they might Institute partial bans. All that stuff might happen. But to cut the long story short, I see this narrative playing out. And this is my investment thesis, and I’m taking an investment on Bitcoin from that particular perspective. So this brings us to the third and final asset or third and final multi bagger, which is AU Small Finance Bank. Okay, so why am I bullish about this? So first and foremost, I believe that AU Finance Bank has a lot of steam left in terms of its growth. So if you take a look at the numbers from 2018 onwards and you will be surprised to see that it is doubling every single year, which is massive growth. From that particular perspective.

Are they growing profitably? Yes, they are growing very profitably. There is absolutely no trouble there. Is it available at a discount? So I would argue, yes, the stock is down by roughly 16% from its peak. Now, why do I believe in the concept of peak for a bank like AU Small Finance? The reason is fairly simple that the company is making its highest ever profits and revenues and it is not rating at its highest ever price. So it will go back to its previous high. That is almost given. It should definitely happen by the next quarter itself. Most likely. So 15% to be gained made there directly. Now comes the investment thesis part for a company like Au Small Finance. So if you take a look at Au Small Finance loan break up,

you will see that almost 30% of the loans are being given in non priority sector and 70% of the loans are given in priority sector lending. Also, there was a statement by the management of Au Small Finance Bank and I’m pasting the screenshot here so you can read it. They are going to focus a lot on the housing portfolio, especially in rural and semi urban areas. Now this is really big. Why? Because there are two three trends at play. So this brings me to the investment thesis of Au Small Finance and there are three things at play.

Number one, you might have heard that a lot of investors are getting attracted to the real estate sector in India. For example, a few days back, I spoke about the fact that India Bulls housing Finance is getting a lot of traction. A lot of investors are getting attracted towards that stock. Why? Because the realty sector in India has been deeply beaten down since COVID and now it has started to come back up. So therefore this housing narrative is going to go up and companies like Au Small Finance, India Bull Housing Finance, they are going to benefit from it. This is the first key point. Second key point. The firm’s focus has been brutal. As I showed you from the screenshot of the firm, is deliberately trying to ramp up its loan portfolio in semi urban rural housing sector, which is a very profitable portfolio for something like Au Small Finance Bank. And guess what. India’s Housing for all mission is also gaining quite a lot of steam because it was put on hold a little bit during COVID and the targets will be pushed very, very high. So where do you think that people are going to take loans from?

So most likely they are going to explore options like Au Small Finance and Third. And finally the company has become a lot more profitable. Now they are going to redeploy that money with focus on their housing loan portfolio. So this is a theme that I’m able to uncover. So this is the reason why I’m an investor in Au Small Finance Bank also. So just to recap the entire article in order to find multibaggers, you have to take calculated risks. You have to build an investment thesis and take bets accordingly. One key thing that I do whenever I’m investing in these type of multi baggers or slightly risky stock is that I take hedging positions elsewhere. For example, it would be futures and options market or buying some defensive stocks. I don’t talk a lot about Fano on this Website because it is super dangerous for retail investors to get into that game. But if there is enough interests, I’ll start teaching that also or not a problem. So let me know and press the like button and I will see you the next time.